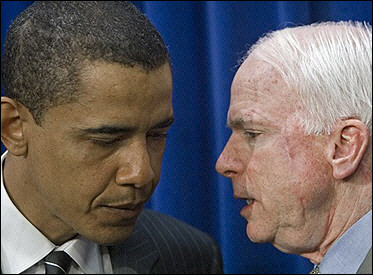

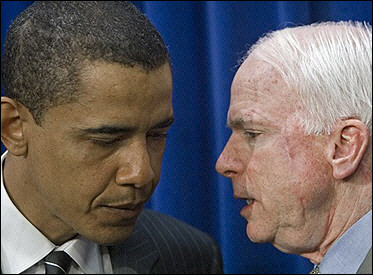

While the overwhelming drama and non-stop media coverage of the democratic primaries has alas come to an end, a historic and monumental election awaits us. Never has there been such a divide on pertinent issues or such a stark difference in the socioeconomic backgrounds of the two candidates.

To some, Obama represents a long awaited revolution; a beacon of hope in the wake of a lagging economy and five years of a questionable war with no clear exit plan in sight. To others, he is merely an inexperienced congressman; a fish out of water whose rhetoric is far more appealing than his potential. McCain: A celebrated POW who endured years of hardship in Vietnam and who, more than anyone, understands the need to get us out of Iraq. To others, he is George W. Bush’s puppet; an obedient replica of our current leader with little variance to offer once he gets into office.

War debate aside, there is an extended agenda of issues on everyone’s mind this year. 47% of Americans cite tax issues as an area of great importance in the 2008 Presidential elections. So where do the two men stand? It has to be more complex than the cliché of the Republican standing behind the white collar worker, handing out tax breaks to corporate executives with the same enthusiasm they use to reject universal healthcare, doesn’t it? In fact, if the wealthy were so apt to align themselves with McCain, how did Obama garner such great support from the hedge fund industry?

Obama and his tirade of tax reform initiatives will no doubt shake up the current plan. From his “Universal Mortgage” credit to his “American Opportunity” initiative, Obama is certainly looking to put back into American’s pockets. But at what cost? While he seems eager to give back to the middle class, he won’t think twice about raising the capital gains tax to 25%. What does this mean?

Capital gains taxes are paid when an individual or corporation realizes a net profit on their assets, generally when an investment is sold at a higher price than what it was purchased for. For hedge fund managers, the capital gains tax is a huge factor, since millions of dollars of securities are traded within that fund.

Let’s say a fund manager takes home $3 million deriving from his 20% standard performance fee that he charges his clients. He will classify that as a capital gain, thus only having to pay $450,000, or 15%. If Obama’s proposal goes through, the fund manager now pays $750,000, or 25% of his income. While this may raise some complaints, supporters say this is still a tax break. If that $3 million were considered a salary as opposed to a capital gain, it would be charged the normal tax rate of 35%, or a little over $1 million.

With much less simpler (and for that matter, less confusing) initiatives, McCain’s focus is less on the middle class and more on the extreme ends of the spectrum. Both wealthy individuals and low-income families will get tax breaks, though the resulting after-tax income differences are no-doubt more prevalent on those who make substantially higher salaries. Rationalizing that low taxes on dividends and capital gains promote savings and financial planning, McCain will keep the current capital gains tax where it is, while fighting “anti-growth” measures brought on my dems. In this sense, he does mirror Bush. In fact, the only time he ever deviated away from his beliefs on the tax front was in 2001, fresh off a bitter primary defeat, where he voted against the Bush tax-cut initiatives. Lucky for the republicans, it didn’t take long before he was right back on track.

What’s interesting was the hedge fund involvement in the primaries that was surprisingly pro-democratic. Through extensive Wall Street contacts, Hillary Clinton amassed millions from prominent hedge funds. However, I think their support slowly faded after her intentions were announced to raise the capital gains tax to 35%, even if Marc Lasry does feign disgust at the “ridiculous” salaries made by hedge fund managers. Not far behind Clinton, Obama brought in a little over $1 million from hedge funds in 2007. McCain barely broke $400,000. One would think they would align themselves with the guy who is going to let them keep more of their income. Some hedge funds are saying they’re giving more to Democrats because of their impatience with Bush’s progress in Iraq and because they see a very real opportunity for them to win control of Congress for the first time in 12 years.

So maybe it is more than the number of zeros in a hedge fund manager’s paycheck. Regardless of the issue, importance is assigned to them by each individual. Maybe the tax issue is the highest for some. Maybe it’s gay marriage or whether or not steroid use in baseball should be persecuted. Either way, this election is unlike any that have come before, and the issue of capital gains is merely one issue that the voter should individually assess.

About Julie Scuderi

Julie Scuderi is the Senior Editor for HedgeCo.Net in New York City where she specializes in producing editorial and technical content for a full range of financial service companies as well as reports on breaking news within the hedge fund industry. Prior to joining HedgeCo, Ms. Scuderi contributed articles to various publications including The Miami Herald, The Reporter and NewsWeek, in addition to writing for the ABC affiliate in Miami, FL. She holds a Masters in Journalism from the University of Miami along with a BA from Rochester Institute of Technology.

Hedge Funds and the 2008 Elections

While the overwhelming drama and non-stop media coverage of the democratic primaries has alas come to an end, a historic and monumental election awaits us. Never has there been such a divide on pertinent issues or such a stark difference in the socioeconomic backgrounds of the two candidates.

To some, Obama represents a long awaited revolution; a beacon of hope in the wake of a lagging economy and five years of a questionable war with no clear exit plan in sight. To others, he is merely an inexperienced congressman; a fish out of water whose rhetoric is far more appealing than his potential. McCain: A celebrated POW who endured years of hardship in Vietnam and who, more than anyone, understands the need to get us out of Iraq. To others, he is George W. Bush’s puppet; an obedient replica of our current leader with little variance to offer once he gets into office.

War debate aside, there is an extended agenda of issues on everyone’s mind this year. 47% of Americans cite tax issues as an area of great importance in the 2008 Presidential elections. So where do the two men stand? It has to be more complex than the cliché of the Republican standing behind the white collar worker, handing out tax breaks to corporate executives with the same enthusiasm they use to reject universal healthcare, doesn’t it? In fact, if the wealthy were so apt to align themselves with McCain, how did Obama garner such great support from the hedge fund industry?

Obama and his tirade of tax reform initiatives will no doubt shake up the current plan. From his “Universal Mortgage” credit to his “American Opportunity” initiative, Obama is certainly looking to put back into American’s pockets. But at what cost? While he seems eager to give back to the middle class, he won’t think twice about raising the capital gains tax to 25%. What does this mean?

Capital gains taxes are paid when an individual or corporation realizes a net profit on their assets, generally when an investment is sold at a higher price than what it was purchased for. For hedge fund managers, the capital gains tax is a huge factor, since millions of dollars of securities are traded within that fund.

Let’s say a fund manager takes home $3 million deriving from his 20% standard performance fee that he charges his clients. He will classify that as a capital gain, thus only having to pay $450,000, or 15%. If Obama’s proposal goes through, the fund manager now pays $750,000, or 25% of his income. While this may raise some complaints, supporters say this is still a tax break. If that $3 million were considered a salary as opposed to a capital gain, it would be charged the normal tax rate of 35%, or a little over $1 million.

With much less simpler (and for that matter, less confusing) initiatives, McCain’s focus is less on the middle class and more on the extreme ends of the spectrum. Both wealthy individuals and low-income families will get tax breaks, though the resulting after-tax income differences are no-doubt more prevalent on those who make substantially higher salaries. Rationalizing that low taxes on dividends and capital gains promote savings and financial planning, McCain will keep the current capital gains tax where it is, while fighting “anti-growth” measures brought on my dems. In this sense, he does mirror Bush. In fact, the only time he ever deviated away from his beliefs on the tax front was in 2001, fresh off a bitter primary defeat, where he voted against the Bush tax-cut initiatives. Lucky for the republicans, it didn’t take long before he was right back on track.

What’s interesting was the hedge fund involvement in the primaries that was surprisingly pro-democratic. Through extensive Wall Street contacts, Hillary Clinton amassed millions from prominent hedge funds. However, I think their support slowly faded after her intentions were announced to raise the capital gains tax to 35%, even if Marc Lasry does feign disgust at the “ridiculous” salaries made by hedge fund managers. Not far behind Clinton, Obama brought in a little over $1 million from hedge funds in 2007. McCain barely broke $400,000. One would think they would align themselves with the guy who is going to let them keep more of their income. Some hedge funds are saying they’re giving more to Democrats because of their impatience with Bush’s progress in Iraq and because they see a very real opportunity for them to win control of Congress for the first time in 12 years.

So maybe it is more than the number of zeros in a hedge fund manager’s paycheck. Regardless of the issue, importance is assigned to them by each individual. Maybe the tax issue is the highest for some. Maybe it’s gay marriage or whether or not steroid use in baseball should be persecuted. Either way, this election is unlike any that have come before, and the issue of capital gains is merely one issue that the voter should individually assess.

About Julie Scuderi

Julie Scuderi is the Senior Editor for HedgeCo.Net in New York City where she specializes in producing editorial and technical content for a full range of financial service companies as well as reports on breaking news within the hedge fund industry. Prior to joining HedgeCo, Ms. Scuderi contributed articles to various publications including The Miami Herald, The Reporter and NewsWeek, in addition to writing for the ABC affiliate in Miami, FL. She holds a Masters in Journalism from the University of Miami along with a BA from Rochester Institute of Technology.