Editor’s Note: Given the importance of pension investors to the hedge fund market, we invite readers to learn more about the challenges faced by fiduciaries. In a newly released article, Dr. Susan M. Mangiero talks about the Six L’s and other drivers for change that keep trustees up at night. In her next article, she will discuss the fiduciary implications of hedge fund selection by pension investors.

Are Your Pension Clients Up to the Challenge?

Pension fiduciaries are increasingly finding themselves in the hot seat as one challenge after another vies for their attention. Complicating things is the fact that the operating environment is dramatically different now. Markets are more global, complex and volatile. The public is ready to pounce at any hint of scandal. Regulators fear another S&L crisis. Senior executives contemplate the effect of Sarbanes-Oxley compliance on retirement plan administration. Governors and mayors struggle with angry taxpayers and shrinking budgets. The list goes on. One thing is certain. The status quo is over. Managing under the old paradigm is sub-par and may even be an open invitation to allegations of fiduciary breach.

The Six Ls

As shown in Exhibit One, economic loss weighs heavily on beneficiaries, shareholders and taxpayers, whether realized or not. An inability to write checks on time, if at all, can trigger a variety of nasty events, including forced borrowing, rating downgrades, diminished cash flow and an unhappy labor force pushed to accept lower benefits in lieu of job loss. At the same time, decision-makers enjoy less protection than before as fiduciary liability underwriters rescind or dramatically limit coverage, increase premiums, and in some cases, require insured parties to demonstrate the efficacy of their internal controls. Some of this stems from an inability to reinsure the risk.

VARIABLEIMPLICATIONS

Exhibit One: Drivers for Change |

|

| Liability | Fiduciary insurance policy costs can go up at the same time that coverage is limited. |

| Liquidity | Existing asset allocations may have to change in order to have an appropriate amount of cash on hand. |

| Literacy | Effective decision-making is not possible unless fiduciaries understand their duties and what it takes to discharge them. |

| Litigation | Pension-related litigation is on the rise for both defendants and plaintiffs. |

| Longevity | Expected longer life spans compel sponsors to offer appropriate investment choices or invest assets themselves to ensure adequate funds. |

| Loss | Notwithstanding the differences among statutory, accounting and economic pension reporting, a reported loss can have direct cash flow impact, may worry taxpayers or shareholders or both and can trigger a regulatory or rating agency review. |

Litigation worries are another driver. Bankruptcy filings, plan terminations, bad investment performance, excess company stock in defined contribution plans and tag-along securities actions contribute to what is seen by many as a growth industry. Statistics from the Administrative Office of the U.S. Courts confirm that ERISA filings have gone up from 9,167 cases in 2000 to 11, 499 cases in 2004. Many posit there is more to come. Defined benefit plan sponsors are under increasing pressure to make up for big losses associated with market reversals, anemic equity returns, widening asset-liability gaps and a wider array of choices, including complex securities and strategies. It only takes a few highly-publicized losses to encourage individuals and institutions to seek redress through the legal system.

Besides fear of default, regulatory action is putting everyone on notice. Questions about the appropriate rate to discount future expected liabilities, whether to continue to allow deficit smoothing and how to close the gap between statutory and economic shortfall reporting are just a few of the things keeping regulators busy. Staggering payouts by the Pension Benefit Guaranty Corporation do not help. Notably, in November 2004, the PBGC announced a fiscal year-end shortfall of $23.3 billion, more than double the amount a year earlier. If there was ever a time to wake up and smell the coffee, this is it. If plan sponsors and their boards do not awaken to the challenges and become proactive, the time to contain the liability exposure may pass.

Add demographics to the mix and trustees really lose sleep. With more than 70 million individuals born during the Baby Boom (1946-1964) and now set to retire, defined benefit plan sponsors can ill-afford to ignore the relationship between longevity and liquidity. At a minimum, plan sponsors need to evaluate current and projected asset allocation strategies to make sure they will have enough cash when needed. A more thorough approach entails some kind of sensitivity analysis so employers better understand what and how liquidity difficulties can arise. The irony is that some firms will invest in higher risk securities, anticipating higher returns but experiencing greater costs if things sour and they are slapped with a lawsuit.

Literacy – or lack thereof–– continues to be a big issue. More than a few fiduciaries are unaware of their status, have limited financial backgrounds, are unfamiliar with the required Prudent Expert standard of care and are not at all comfortable with cornerstone concepts such as asset allocation, diversification, hedging, risk measurement, operational controls and suitability. Making matters worse, retirement plan decisions may get short shrift because no one is available on a full-time basis to address them. These personnel issues are far from trivial. Not addressing them could signal a lack of commitment to putting and keeping good stewards in place. On a positive note, there are things that can be done to implement best practices with respect to staffing, some of which are shown in Exhibit Two.

New Paradigm

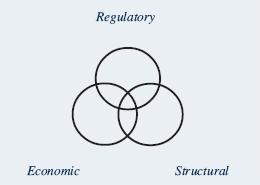

As pension issues make their way to the executive suite and the statehouse equivalent, the notion of an integrated framework for pension management is gaining ground. Best fiduciary practices are slowly, but surely, being viewed as a combination of regulatory, economic and structural activities, as illustrated in Exhibit Three. Several reasons account for this new paradigm, not the least of which is the recognition that pension management is a more complex process today than it was even five years ago. It is virtually impossible to discharge fiduciary duties without acknowledging that regulation and the structural framework have a direct impact on investing and related risk management decisions. At the same time, an inability to finance promises (or correctly make defined contribution recommendations that reflect the employee base) puts a sponsor at risk, inviting regulation. Just as important, being a good watchdog requires access to information, something that is not possible without paying for a comprehensive database and analytic engine. Probably most important is having a senior level buy-in that retirement benefits are an integral part of effectively motivating the workforce.

Exhibit Two: Fiduciary Literacy Best PracticesACTION STEPS

|

Investing and Risk Managment

With respect to the management and overall care of pension assets, there is a veritable feast of fiduciary hot buttons. Questions about whether to use derivatives, invest in hedge funds, mark-to-market private equity and venture capital holdings, establish uniform controls for external money managers or develop (and compute) risk measurement standards are paramount to core principles of prudence, loyalty and care. As Exhibit Four suggests, pension plan sponsors who automatically reject derivatives out of hand may find themselves on the defensive, trying to explain the absence of a well thought-out plan. Some even posit a fiduciary duty to hedge market risk against changes in interest rates, equity values, commodity prices or currency movements. Plans that invest in (or recommend) instruments or funds with a short performance history, sloppy record-keeping or excessive use of leverage, inter alia, could find themselves in trouble. Even when no loss occurs, fiduciaries may be held accountable, and asked to explain poor performance, payment of high fees or use of particular outside service providers. All of these consequences can result from the lack of applying a stringent standard of care to managing the retirement plan.

Procedural prudence is everything. This term implies that the process by which information is gathered, evaluated and acted upon is the core activity by which the plan fiduciary is evaluated. This means having clear and detailed documentation, including an Investment Policy Statement which sets forth a plan’s objectives and constraints, along with specific guidance about permissible investments. Beyond that, interested parties should be able to evidence a cogent process about why and how a particular decision was made. Keeping good records of “what if†sensitivity analyses, notes from meetings about investing in new products and back-up research are a few examples. Having a robust paper trail in place for several years allows someone else to reconstruct the due diligence and decision-making processes. This is a lifesaver for anyone who remains after the original trade or process architect has resigned, retired or transferred elsewhere.

Exhibit Three: Integrated Framework

|

Conclusion

As Confucius aptly voiced, “a journey of a thousand miles begins with a single step.†Fiduciaries have their work cut out for them. Guided by law but hopefully inspired by the spirit of promisekeeping, anyone in a position of trust knows what is at stake. Knowledge, experience and process are the three touchstones without which the pension system is likely to crumble. Managing operational, regulatory and investment risk is a big job. Taking action now, even incrementally, is really the only choice.