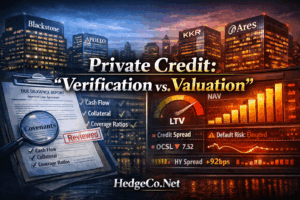

Alternative Investments 2026 “Private Credit” Stress Test:

Strategic Pivots: The Flight to Quality: (HedgeCo.Net) For the past five years, private credit has been hailed as the “Golden Child” of alternative investments. Following the retreat of traditional banks under Basel III and IV capital constraints, non-bank lenders—led by […]